Fabulous

Sky-High Hidden Costs Stun Prospective NYC Renter: Unveiling the Shocking Truth Behind Astronomical Apartment Fees

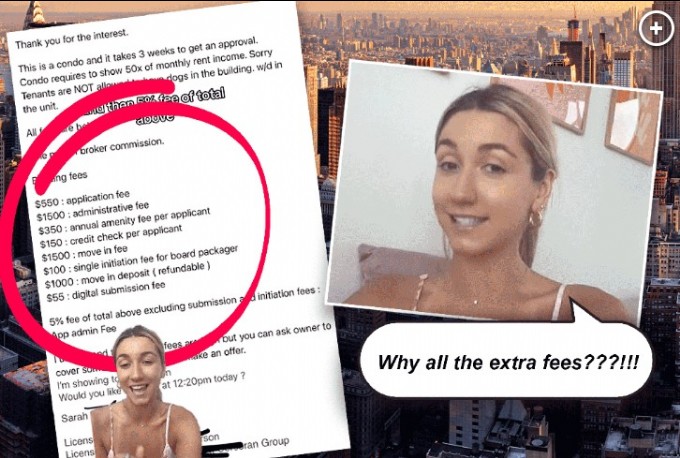

Piper Phillips, an aspiring tenant hunting for the perfect one-bedroom apartment in the heart of Manhattan, was blindsided by an unexpected financial bombshell. Her dream of securing a Midtown condo turned into a costly endeavor when she was confronted with an array of jaw-dropping additional fees, skyrocketing her initial expenses to an astounding $21,507.50, including security deposit and first month's rent. As New Yorkers face increasingly competitive housing markets, this revelation sheds light on the legality and fairness of such exorbitant charges.

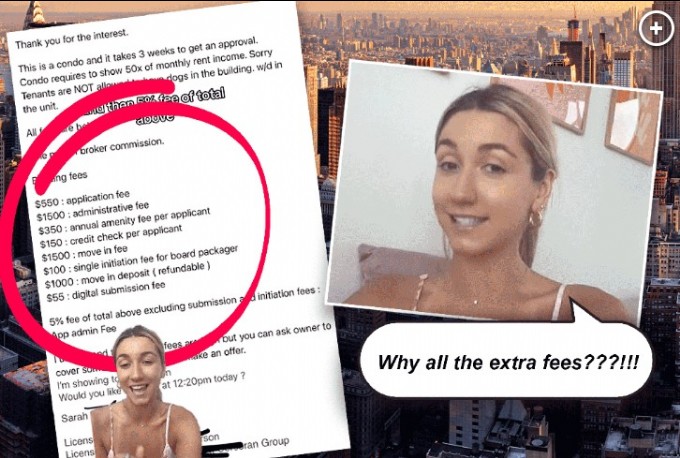

The Unveiling of Astonishing Fees: Piper Phillips had believed she had hit the jackpot in her pursuit of a coveted Manhattan one-bedroom apartment. However, her excitement turned to disbelief when she was confronted with a slew of unexpected costs totaling over $10,000. These supplementary charges, on top of the already steep monthly rent, included a $550 application fee, a $1,500 administration fee, a $1,500 "move-in" fee, and a one-month broker's commission.

Navigating the Shocking Details: The Chicago native expressed astonishment at the hidden costs attached to the upscale listing, which would have amounted to a staggering $5,350 per month. Phillips' sentiments were echoed by a real estate expert interviewed by The Post, who deemed the fees "well above the norm." The unexpected financial strain posed a challenge for Phillips and her boyfriend, whose budget was already stretched by the apartment's high price tag.

TikTok Revelation and Building's Requirements: Phillips turned to social media, sharing the details of her apartment search journey on TikTok. She posted a screenshot of the broker's email that listed the additional fees, causing her to "laugh out loud." The luxury apartment, which boasted coveted amenities like an in-unit washer and dryer, required tenants to earn 50 times the monthly rent. However, the multitude of extra costs shocked Phillips.

A Deluge of Fees: Aside from the standard first month's rent and deposit, the landlord demanded an array of fees: a $550 application fee, a $1,500 administrative fee, a $350 annual amenity fee, a $150 credit check fee, a $1,500 "move-in" fee, a $100 "single initiation fee," a $1,000 move-in deposit, and a $55 digital submission fee. Additionally, an "app admin" fee of 5% on top of building fees was required.

Latest News

Piper Phillips, an aspiring tenant hunting for the perfect one-bedroom apartment in the heart of Manhattan, was blindsided by an unexpected financial bombshell. Her dream of securing a Midtown condo turned into a costly endeavor when she was confronted with an array of jaw-dropping additional fees, skyrocketing her initial expenses to an astounding $21,507.50, including security deposit and first month's rent. As New Yorkers face increasingly competitive housing markets, this revelation sheds light on the legality and fairness of such exorbitant charges.

The Unveiling of Astonishing Fees: Piper Phillips had believed she had hit the jackpot in her pursuit of a coveted Manhattan one-bedroom apartment. However, her excitement turned to disbelief when she was confronted with a slew of unexpected costs totaling over $10,000. These supplementary charges, on top of the already steep monthly rent, included a $550 application fee, a $1,500 administration fee, a $1,500 "move-in" fee, and a one-month broker's commission.

Navigating the Shocking Details: The Chicago native expressed astonishment at the hidden costs attached to the upscale listing, which would have amounted to a staggering $5,350 per month. Phillips' sentiments were echoed by a real estate expert interviewed by The Post, who deemed the fees "well above the norm." The unexpected financial strain posed a challenge for Phillips and her boyfriend, whose budget was already stretched by the apartment's high price tag.

TikTok Revelation and Building's Requirements: Phillips turned to social media, sharing the details of her apartment search journey on TikTok. She posted a screenshot of the broker's email that listed the additional fees, causing her to "laugh out loud." The luxury apartment, which boasted coveted amenities like an in-unit washer and dryer, required tenants to earn 50 times the monthly rent. However, the multitude of extra costs shocked Phillips.

A Deluge of Fees: Aside from the standard first month's rent and deposit, the landlord demanded an array of fees: a $550 application fee, a $1,500 administrative fee, a $350 annual amenity fee, a $150 credit check fee, a $1,500 "move-in" fee, a $100 "single initiation fee," a $1,000 move-in deposit, and a $55 digital submission fee. Additionally, an "app admin" fee of 5% on top of building fees was required.

Jennifer Lopez looks ageless in a towel in no-makeup video

Amanda Holden spanks her derriere and thanks Spanx

Amanda Holden shows off more than bargained as she dances around in her outfit of the day

Meet Harley Cameron, the stunning model who went from a BKFC ring girl to become a pro wrestler and found love

GreenGirlBella, Rocks Emirates Stadium in Painted Home Kit

Amanda Holden calls herself a 'good girl' in white dress with 'cheeky' split

Mum slammed by parents after flashing thong in school run outfit

Lottie Moss makes jaws dropp as she shows off her flawless body

Amanda Holden wears nothing beneath plunging white dress

Comments

Written news comments are in no way https://www.showbizglow.com it does not reflect the opinions and thoughts of. Comments are binding on the person who wrote them.